Business Value protection Trust

A well-constructed plan is essential to protect the value of the business and provide cash for the family in the event there is a major disruption in the business due to a co-owner’s death, disability, retirement or serious major illness or any other event that jeopardizes the continuity of the business.

-

Our UBiz ensures a smooth transition of the business to the other co-owner(s) and the value of your share of the business is protected against an event such as:-

-

Death

-

Bankruptcy

-

Incapacity

-

Divorce

-

Ill health

-

Loss of professional license

-

Retirement

-

Deadlock between co-owners

-

-

Our UBiz Consists Of:-

-

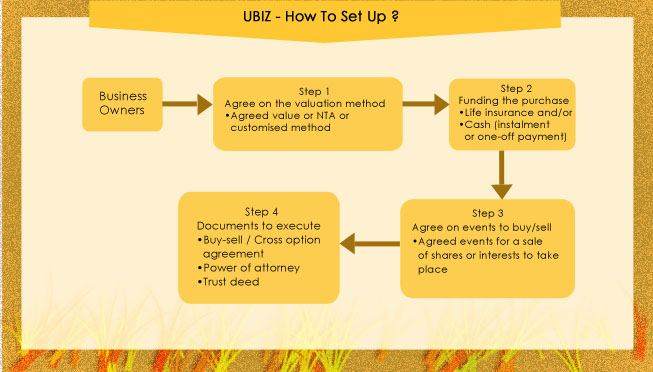

Buy-Sell or Cross Option Agreement: covering the terms of the sale and purchase including the agreed value or formula, events triggering a sale, funding and mode of payment.

-

Power of Attorney: authorizing us, Rockwills Trustee, to transfer the shares/interests to the other co-owner(s) upon the occurrence of the agreed events that trigger a sale.

-

Trust Deed by the co-owners: instructions to Rockwills Trustee regarding the periodical distribution of the sale proceeds to prevent these being misspent by the beneficiaries.

-

Life insurance policy: as the main funding mechanism to purchase the shares/interest of the outgoing co-owner.

-

-

How To Set-Up?

-

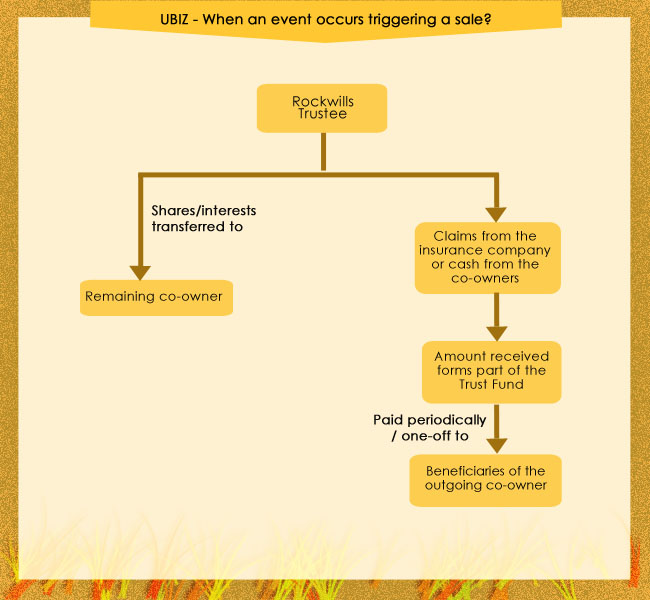

When An Event Occurs Triggering A Sale

-

Guarantees the sale of shares/interest at a full and fair value that was agreed by co-owners.

-

Prevents inexperienced and unqualified heirs from being involved in the business or the selling of the deceased’s shares to outsiders.

-

Smooth transfer of ownership to the co-owners is ensured by the Trustee.

-

Using life insurance, the purchase of the shares/interest becomes very affordable, minimizing the need to use your savings for the purchase.

-

Rockwills Trustee acts as the Trustee for UBiz protecting the interests of your beneficiaries and that of the co-owners.

-

Shares/interests are easily converted

Before you set up a trust, you need to be aware of anti-money laundering regulations.

![]() Click Here

Click Here

Ask yourself:-

-

If a co-owner dies today, can you work with his family to run the business?

-

Will the co-owner’s family members know how to run the business with you?

-

Can they work well with you?

-

Would your beneficiaries be able to get a fair price?

-

Do you have the funds to buy out the co-owner’s shares/interests from the family members when there is no pre-agreed price in a written agreement?

-

Can the shares/interests you are purchasing be transferred quickly to you?